The Price-to-Earnings ratio (P/E/A/R) is a widely used financial indicator employed by investors to assess a business’s fair market value. It provides valuable insights into how investors perceive a company’s growth and profitability. This comprehensive article delves into the P/E ratio, offering an explanation of its definition, calculation methodology, and practical applications.

What is P/E Ratio

The Price-to-Earnings ratio (P/E ratio) is a fundamental metric that gauges a stock’s value relative to its earnings per share (EPS). It quantifies the amount investors are willing to invest in exchange for each dollar of the company’s profits. A high P/E ratio suggests optimism among investors regarding the company’s potential for future profit growth, while a low ratio indicates a more pessimistic outlook.

Calculating the P/E Ratio

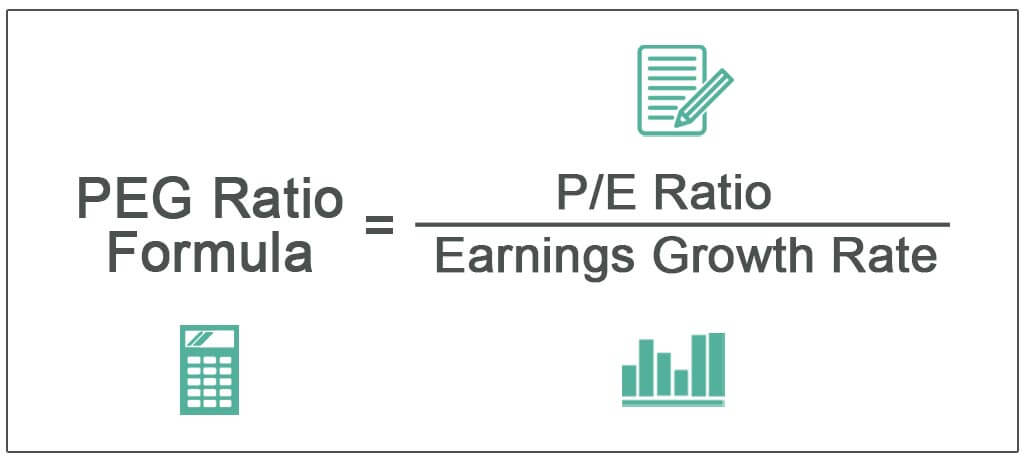

The formula for calculating the P/E ratio is straightforward, involving the division of the stock price by the company’s earnings per share (EPS). Mathematically, it can be expressed as:

P/E Ratio = Market Price per Share / Earnings per Share (EPS)

For example, if a stock is trading at $50 per share and generates $2 per share in profit, the P/E ratio would be 25 (50/2).

Interpreting the P/E Ratio

Interpreting the P/E ratio can be complex without additional context about the company’s industry, growth prospects, and market conditions. A high P/E ratio generally indicates investor optimism regarding future profits. However, the P/E ratio’s usefulness is maximized when compared to similar companies within the same industry.

A low P/E ratio may signal undervaluation or financial challenges within a company, but it can also indicate concerns about its future prospects or management’s ability to sustain profitability.

Also Read: Craigslist San Antonio: Complete Guide of Local Online Classifieds

Importance of the P/E Ratio for Investors

The P/E ratio is a vital metric for investors, serving as a gauge of a stock’s worth and growth potential. By analyzing the P/E ratios of various companies, investors can identify promising investment opportunities while gaining insights into market sentiment and investor confidence.

Factors Influencing the P/E Ratio

Several factors can influence a company’s P/E ratio, including:

- Industry Dynamics: Industries vary in terms of growth potential and risk, leading to differing P/E ratios. For instance, technology companies often command higher P/E ratios compared to utility companies.

- Growth Prospects: Companies expected to experience above-average profit growth may receive higher P/E ratios as investors anticipate future profitability.

- Market Conditions: Stock P/E ratios are susceptible to market sentiment and macroeconomic factors. Economic downturns or market corrections can lead to lower P/E ratios due to increased uncertainty and risk aversion.

Examples of P/E Ratios in Different Industries

P/E ratios vary across industries, reflecting their unique characteristics:

- Technology Industry: Technology companies, known for rapid growth, typically exhibit higher P/E ratios. For instance, a P/E ratio of 40 for a renowned software company may indicate strong investor confidence in future profitability.

- Utility Industry: Utility companies, characterized by stability, often have lower P/E ratios.

- Retail Industry: Retail businesses’ P/E ratios fluctuate based on growth expectations and market conditions. E-commerce firms may have P/E ratios around 50, while traditional brick-and-mortar stores may have lower ratios.

Limitations of the P/E Ratio

While valuable, the P/E ratio has limitations, including:

- Industry Comparisons: Comparing P/E ratios across different industries may yield misleading results due to varying growth potentials and risk profiles.

- Accounting Differences: Variations in accounting principles and procedures can affect earnings estimates and, consequently, the P/E ratio. Ensuring uniformity in accounting practices is essential for accurate comparisons.

- Cyclical Industries: The P/E ratio may be inadequate for assessing profitability in cyclical industries, as earnings can fluctuate with economic cycles.

Conclusion

The P/E ratio is a valuable tool for assessing a company’s future profit potential and market perception. It aids in stock valuation and the identification of attractive investment opportunities. When evaluating investments, investors should consider the P/E ratio alongside other fundamental analysis techniques.

By understanding the P/E ratio and its calculation, investors can gain valuable insights into a company’s growth prospects and market valuation.

Frequently Asked Questions (FAQs)

What is considered a good P/E ratio?

The assessment of a good P/E ratio depends on factors like industry, growth expectations, and market conditions. In general, lower P/E ratios are favored by value investors, while higher ratios may suggest growth opportunities.

Can the P/E ratio be negative?

Yes, the P/E ratio can be negative when a company reports negative earnings. However, negative P/E ratios are less common and require further analysis to understand the reasons behind the negative earnings.

Is a high P/E ratio always positive?

Not necessarily. A high P/E ratio can indicate market confidence and growth expectations, but it can also suggest an overvalued stock. Other factors should be considered alongside the P/E ratio for a comprehensive analysis.

How often should I analyze a company’s P/E ratio?

The frequency of P/E ratio analysis depends on your investment strategy and the company’s circumstances. It is generally recommended to periodically review the P/E ratio, especially when significant changes occur in the company’s financial performance or market conditions.

Can the P/E ratio be used to compare companies across different industries?

Comparing P/E ratios across different industries may not provide accurate insights, as industries have varying growth rates and risk profiles.